Trade and transaction banking is one of the most diverse and exciting areas of the financial world. But what exactly does a career in trade finance entail? And what are some of the top trade finance jobs?

LIBF Insights considers some of the roles and responsibilities in trade and transaction banking, as well as how you can take the first steps on what could be a varied and rewarding career in the sector.

Trade finance: the unsung hero of the financial world

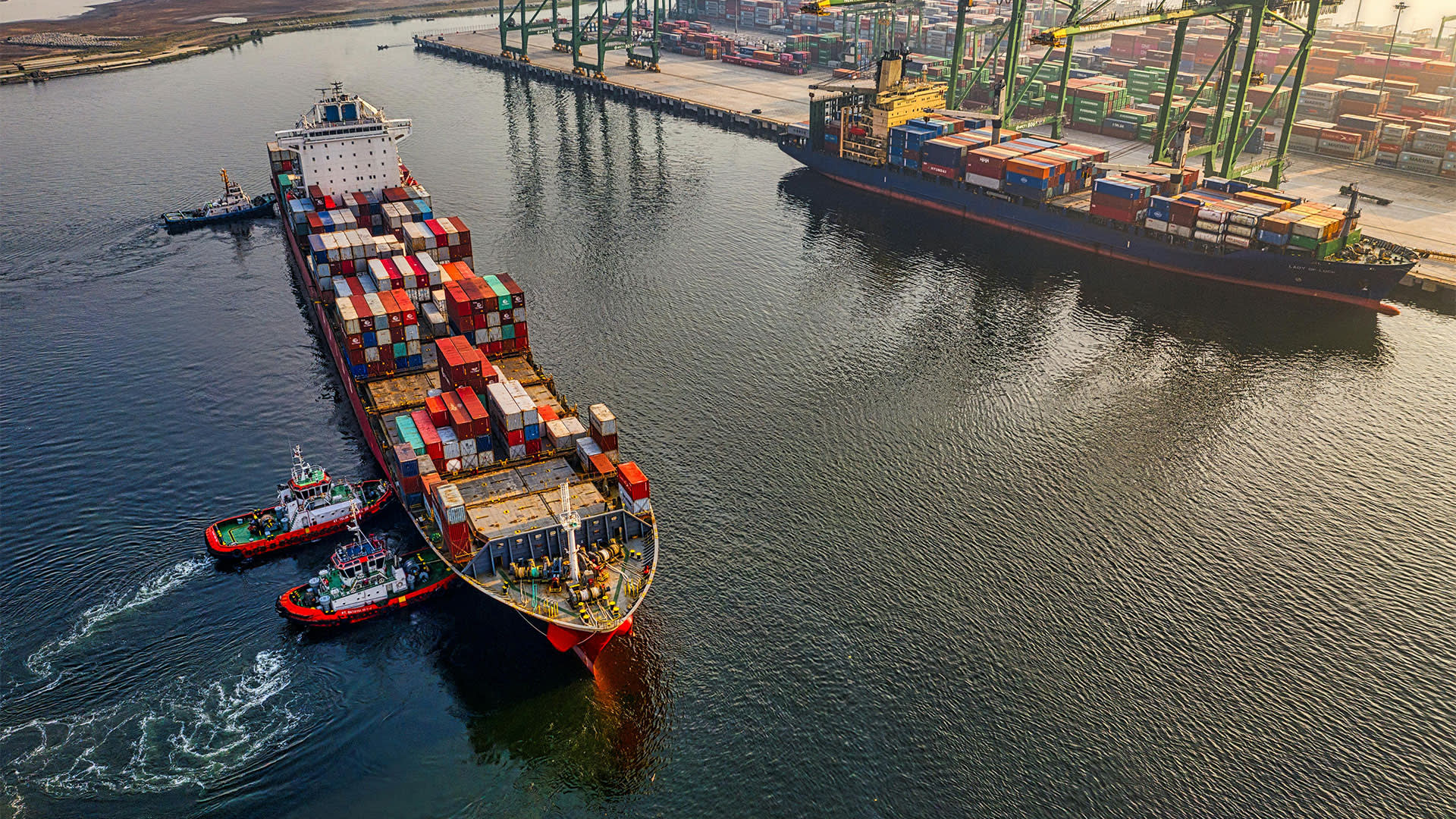

When it comes to jobs in financial services, most people are familiar with the more headline-grabbing roles, such as those in investment banking or stock broking, but many are unfamiliar with what exactly a career in trade finance involves. Yet, trade and transaction banking is the backbone of modern commerce – every time a product moves from one country to another, trade and transaction banking professionals work to ensure the transaction runs smoothly, that any risk is adequately managed and that payments are made in accordance with their client’s requirements.

In fact, roughly 80% to 90% of global trade relies on trade finance, according to figures from the World Trade Organization. And financing trade involves a network of organisations and financial institutions, with an often complex compliance landscape to navigate.

“Working in trade and transaction banking allows you to make a real, tangible impact – not just in the financial world, but in our everyday lives,” says Alex Gray, Head of Trade and Transaction Banking at LIBF.

“Most people will appreciate the importance of commodity imports, such as oil, but you can also make a real impact at a consumer level. For example, if you enjoy the occasional glass of beer, then chances are a trade and transaction banking professional has facilitated the import of brewing equipment to allow that pint to be served in your local pub.”

What does a career in trade finance involve?

A career in trade finance involves working with various financial instruments and products to facilitate international trade. This might involve liaising with exporters, importers, banks, and other financial institutions to provide financing solutions that enable companies to conduct trade across borders.

Trade finance professionals need to understand international trade laws, regulations, foreign exchange, and risk management. What’s more, due to the international nature of the work, they often require an understanding of the economic and political conditions in different regions of the world. Additionally, trade professionals need to be adept at building and maintaining relationships with clients and partners around the globe.

There are numerous possibilities when it comes to potential jobs in trade finance. You could find yourself employed as any of the following:

Analyst

Trade Relationship Manager

Document Checker

Compliance Officer

Trade Risk Manager

Product Manager.

What qualifications do you need to work in trade finance?

There’s no set route into trade and transaction banking but there are qualifications that can help you to build your knowledge of the trade finance landscape. Many LIBF alumni who have gone on to have successful careers in trade and transaction banking, started their educational journey with our Level 3 qualification, the Certificate in International Trade and Finance (CITF).

Alternatively, those looking to upskill and pursue a specialist area within trade and transaction banking can pursue one of our Level 4 qualifications:

“When it comes to securing a job in trade and transaction banking, having the right qualifications can make all the difference. If you haven’t got something like CDCS or CDCG, for example, you’re unlikely to make it to the interview stage for related roles,” comments Gray.

“Similarly, you might be a banking professional looking to transition into a trade finance-related role – a qualification like our Certificate in International Trade and Finance is a great way to attain the necessary expertise and demonstrate it to a hiring manager.”

Is trade finance a good career choice?

For those with a global mindset, an eye for detail, and a thirst for varied challenges, trade finance can be a fantastic career choice. It also gives you the chance to make a real, tangible impact on international trade – every deal you facilitate has a direct impact on businesses, economies, and even the end consumers.

“Trade and transaction banking is one of the most exciting and rewarding areas of the financial world. With the right qualifications, you can embark on a career that might see you travel all over the world, working with international organisations and playing a very real role in supporting the global economy,” adds Gray.

Related articles

Jobs in finance: why should I pursue a career in sustainable finance?

01 June 2022

What kind of role would best suit you?